Saudi Economy in 2021 has grown above expectations and we forecast higher momentum in 2022. Since COVID-19 restrictions are being relaxed, it will also

have a positive impact in boosting religious travel.

Conducive government policies, including Vision 2030, focusing on economic diversification, are expected to propel the economic growth of the Saudi economy. The Government’s planned expenditure for 2022 stands at SR 955 billion, while total public revenues are forecast to reach SR 1,045 billion, on the strength of domestic economic recovery and higher oil prices.

The Saudi economy grew by 6.8% in Q4 of 2021 compared to same quarter 2020. After contraction in Q1 and Q2, GDP expanded in Q3 and Q4, mainly driven by growth in oil activities. In Q4 2021, the positive growth was due to the high increase in oil activities by 10.8%, non-oil activities increased by 5.0% and government services activities by 2.4%, compared to same quarter last year.

2022 Economy Outlook

Saudi economy is expected to grow by another 7% YOY in 2022, fueled by considerable oil sector growth, improved non-oil growth, and the Government’s continued investments in driving economic growth. The major risk in the foreseeable future would be the unpredicted trajectory of COVID-19, especially the emergence of new variants.

The Insurance Market in Saudi Arabia

(Note: Overall results from Q4 2021 have not been published yet)

Insurance companies in the Kingdom have displayed a continuous growth trajectory in recent years, with the aggregate Gross Written Premiums (GWP) by the end of Q3 2021 amounting to SR 31.81 billion, which is an increase of 7.7%. This period also witnessed a higher demand from customers for digital solutions due to the adoption driven by the lockdown the year before. As a consequence; digitally-ready insurance companies were able to make full use of their digital capabilities in meeting customer demand. Bupa Arabia, with its highly digitised operations and services, was able to benefit from this trend the most.

Below is an overall view of the insurance industry in KSA as per 2021 Q3 data.

GWP's 2021 Market Share

(Note: Overall results from Q4 2021 have not been published yet)

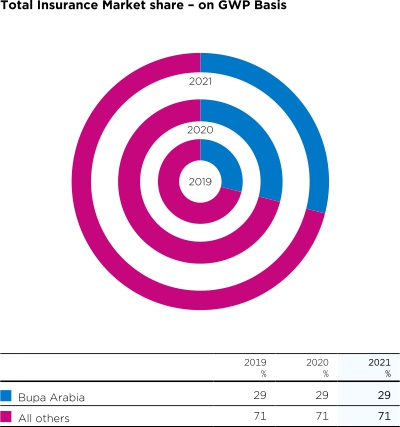

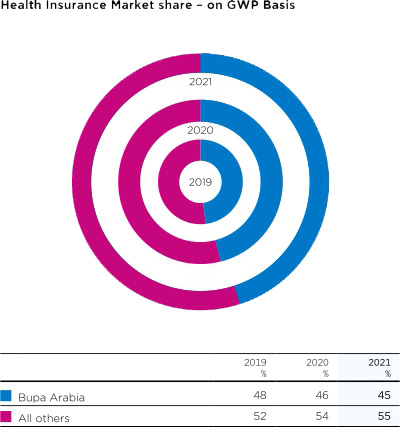

Bupa Arabia is the largest insurance in the overall insurance market with +29% market share, driven by its leadership in the health insurance sector which represents approximately 60% of the total market. Below is the comparative performance of the Company in relation to competitors in the industry.

Market share and positioning

Market Value Share 2021 (GWP) Health Segment

According to CHI’s published data, Bupa Arabia leads the health insurance industry in Saudi Arabia with an approximate 48% market share of insured population by the end of 2021.

Health Insurance Industry 2022 Outlook

While we remain cautiously optimistic; we believe the health insurance industry will be impacted, positively by some, negatively by some, by the following factors:

- Macro-economic factors: pace and robustness of post-pandemic recovery, as restrictions are lifted as well as the impact of oil prices surge coupled with ongoing logistical challenges from the prior year. These factors will have an impact on the employment market which is the fuel for

health insurance. - Regulatory factors:

- By comparing GOSI’s employment data at the end of Q4 2021 with CHI’s insured employees; the current insured population is estimated to be about 30% less than the potential market when the full enforcement of CHI’s mandate is fully implemented by the regulator. This will be the biggest driver for market growth when it materializes to compensate for the continuous decline of the insured population over the past few years as a result of expats exodus.

- Enforcement of domestic helpers’ health insurance will bring in a new segment to the market. While domestic helper-employer liability insurance has been announced by the Saudi Central Bank; the health insurance cover for domestic helpers is yet to be enforced by CHI.

- Launch of an improved health insurance policy under the name of Essential Benefits Package by CHI, to be implemented as of July 1st 2022, will provide better and higher benefits to insured members but will result in a higher cost than the sector must price for to neutralize the utilization risk.

- Full impact of NPHIES roll-out which comes at a price tag of 2% of claims, on top of existing regulatory levies of 1.5% of GWP.

- Full impact of Article-11 which was implemented beginning of 2021 with partial impact, due to the none-readiness of government providers, and we expect to see the full impact of Article-11 in 2022 due to continuous upskilling and levelling up of resources and systems at their ends. This article enforces the use of around 200 government providers as part of insurance companies’ networks at services prices set by CHI.

- Market behavioral factors:

- An emerging behavior from medical providers to cross-sell and up-sell their services, leading to higher utilization.

- Geographical expansion of leading high-end providers that will adversary impact claims cost.

- A noticeable pick-up in members’ utilization and frequency of visits to medical providers.